Problem: How do you build a real-time risk model?

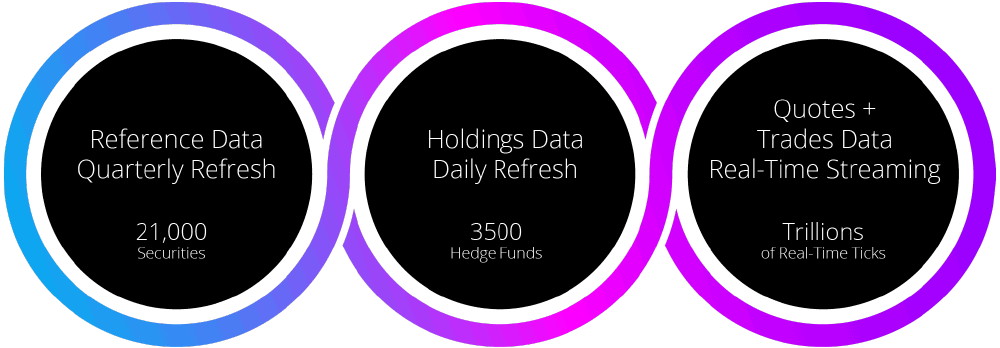

Financial services organizations managing complex portfolios need to understand the impact of billions of market transactions every day, each one with the potential to materially affect the risk exposure of their portfolio. They want real-time insight into risk to maximize revenue and minimize downside to meet both business and regulatory requirements.

Numerous recent examples abound that highlight how investment firms’ systems did not react fast enough to spot significant exposure. Lenders typically examine aggregate risk on weekly and monthly lag cycles despite increasingly volatile markets where assets swing widely on an intraday basis.

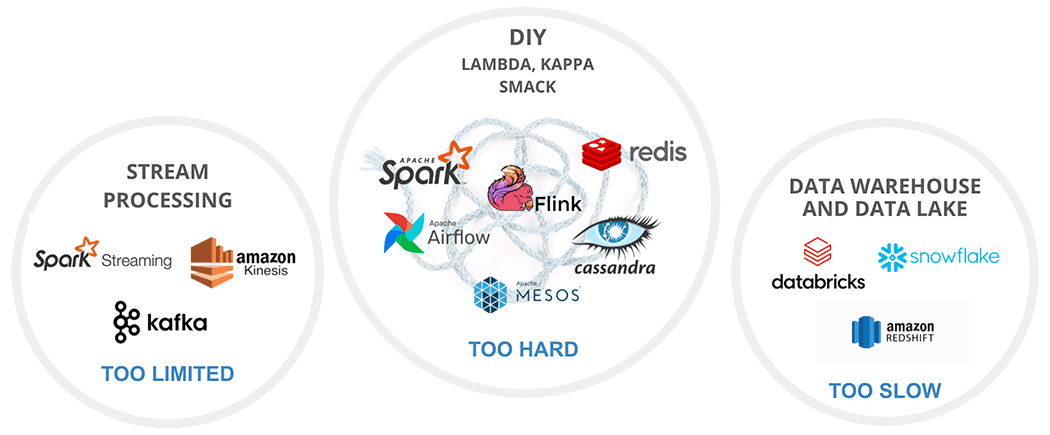

Challenge: Existing technologies all have critical flaws

Even modern data systems are poorly designed to handle the high-cardinality joins and the constant aggregation and re-aggregation as new data forces re-evaluation of positions. Stream processing tools lack the context of holdings and reference data. Batch processing with traditional data systems are too slow and give only a rear-view picture. Trying to combine the two by stitching together specialized tools in the fabled lambda/kappa architectures is just too complex, and these solutions lack specialized capabilities such as temporal joins and AS-OF joins.

- No context or data fusion

- Limited time series

- Complex data engineering

- Intense infrastructure management and coordination

- Difficult to troubleshoot

- Complex data engineering

- Latency issues

- Rudimentary time series

Solution: Kinetica – A Real-Time Database

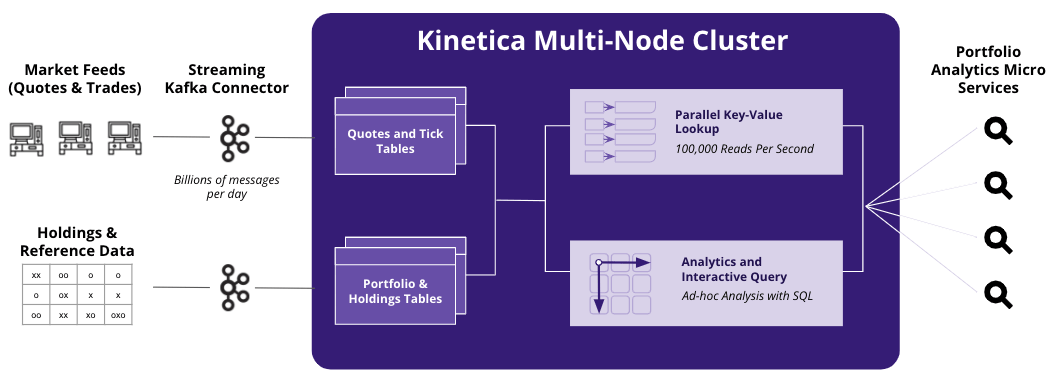

Financial services organizations are turning to Kinetica – a real-time analytics database, to monitor and assess the impact of billions of market transactions per day on complex portfolios. Kinetica is able to fuse together streaming market data with static reference data for a full and constantly updated picture of positions with context on risk and exposure. A lockless architecture and vectorized compute algorithms allow for continuous re-aggregation as streaming data changes, and enable you to do complex analysis on demand using the most up-to-the-moment data.

Demo: Mark-to-Market with Ease

See how easy it is to develop an application that continuously monitors portfolio risk. In this demo we'll take reference holdings data and fuse it together with live market data for complex analysis, and a continuously up-to-date picture of risk, opportunities and mark-to-market valuations of assets.

“We took out 700 nodes of Spark and Redis, They were spending tons and tons of money on hardware and hundreds of thousands, millions of lines of Spark-Flink type code. We were able to reduce that to several thousand lines of SQL.

Kinetica - The Database for Real-Time Analytics that Scales

Freshest Possible Data

Lower TCO

Time Series Analysis

Book a Demo!

The best way to appreciate the possibilities that Kinetica brings to high-performance real-time analytics is to see it in action.

Contact us, and we'll give you a tour of Kinetica. We can also help you get started using it with your own data, your own schemas and your own queries.